What is Digital Banking?

AIDI PENG – Postgraduate student, Queen's Management School

What is the Difference Between Online and Digital Banking?

It is noted (Darry, 2019) that these two terms are synonymous for the most part. Digital Banking may be mistaken for the same as online banking. In China, Digital Banking is just started, so many Chinese may be confused about two different banking. Actually, their basic bank business is the same. To be more precise, digital banking is a Pure virtual bank and doesn't have any physical bank in the real world. Moreover, many Chinese are getting used to using some mobile payment applications. For example, like the Alipay, WeChat Pay, PayPal, and Apple Pay are not digital banking, online banking, either. Besides, Digital currency (bitcoin,Litecoin,PPCoin, etc) is not the currency of Digital Banking. It is worth mentioning that China government and Central banks launched the world's first 'Central Bank Digital Currency (CBDC)'-Digital Currency Electronic Payment on August 14, 2020(Gu, 2020).

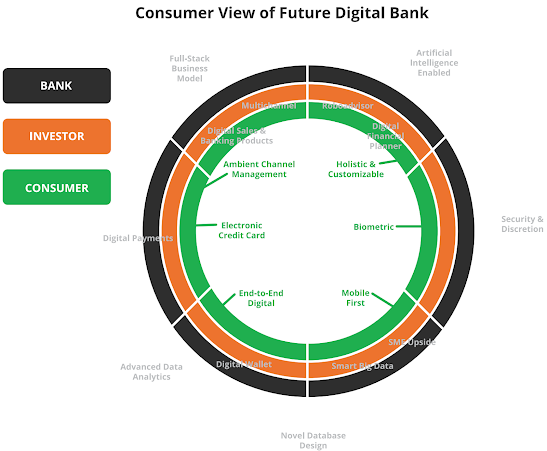

Key Requirements for a Digital Bank – Customers’ Perspective

As a virtually commercial bank, 'DBF'(Lipton, Shrier and Pentland, 2016) should be able to do the following:

Lipton, Shrier, and Pentland(2016) have said that DBF should provide a full bank service. Such as customers' current account, deposit balances, transaction, outstanding loans, pension, and Financial endowment. Design special services for a different group, like different ages people, formal and informal businessmen, ordinary customers, and VIP customers as well as overseas customers. The most thing important is that 'DBF'(Lipton, Shrier and Pentland, 2016) should offer a trusted, relatively inexpensive credit and higher rates deposit.

The development of digital banking has mainly gone through three stages

• The first stage: Bank automation

• The second stage: Electronic banking

• The third stage: Bank digitization

Three common digital banking introduces

• Monzo

Monzo is digital banking situated in the United Kingdom.

Recommend: ★★★☆☆☆

Advantage:

1. Easy to create an account.

2. Simple interface.3. Main British use. (18K downloads in UK Apple App store)

4. High safety coefficient. Disadvantage:

2. Foreigners may not succeed verify an account.

The Financial Brand report that PwC's 2017 Digital Banking Consumer Survey gives bits of knowledge into the quickly changing conduct of the digital bank client. The most noteworthy finding was the ascent of a quite certain gathering that PwC alluded to as 'Omni-advanced'(Marous, 2020). The report explicitly highlighted another type of client that is marked as 'Omni-advanced'(Makad, 2020) or the individuals who progressively favored digital modes to direct their banking, generally maintaining a strategic distance from physical channels of banking.

• Starling bank

Starling Bank was established in 2014 by industry-driving investor Anne Boden and its administrative center is in London.

Recommend: ★★★★☆

Advantage:

1. Easy to create an account.

2. Simple interface and fully-functional.3. Very popular (149K in downloads in the UK Apple App store).

4. High safety coefficient and get a physical Debit Card for free.

Disadvantage:

1. Only have the English language operation interface.

1. You will spend at least £ 4.99 to get a physical Debit Card.

3. High safety coefficient.

Advantage:

2. The Debit Card will almost take one week to deliver to you or even longer.

3. Can't add other Commercial Bank Card in the mobile phone application.

• Revolut

Revolut Ltd is a British monetary innovation organization settled in London.

Recommend: ★★★★☆

Advantage:

1. Easy to create an account.

2. Simple interface and fully-functional.

3. Provide many kinds of language operation interface.

4. Extremely popular (386K in downloads in the UK Apple App store)

5. High safety coefficient

6. Offer many kinds of Debit Card to choose from.

7. Can add other Commercial Bank Card in the mobile phone application.

Disadvantage:

2. Can't add China Commercial Bank Card in the mobile phone application.

• InMotion

InMotion is a digital banking application of CHINA CITI BANK INTERNATIONAL.Recommend: ★★☆☆☆

Advantage:

1. Easy to create an account.

2. Simple interface.3. High safety coefficient.

Disadvantage:

1. Only provide Hongkong citizens to use.

• Unionpay Non-boundary Card

China UnionPay released the first digital bank card "UnionPay Non-boundary Card" on August 31, 2020.

Recommend: ★★★☆☆

1. Many China Commercial Bank's Mobile Banking provides services to apply for this Bank Card.

2. You can choose a digital banking credit card or debit card.

3. High safety coefficient and get a physical Debit Card for free.

Disadvantage :

1. No digital banking mobile application.

2. You need to in China Commercial Bank's Mobile Banking to use this card.

3. Only provides the digital banking services for Chinese.

2. You need to in China Commercial Bank's Mobile Banking to use this card.

3. Only provides the digital banking services for Chinese.

References

Darry, P., 2019. What Is Digital Banking?. [online] Temenos. Available at: <https://www.temenos.com/news/2019/12/19/what-is-digital-banking/> [Accessed 10 October 2020].

Makad, S., 2020. What Is Digital Banking: Definitions, Benefits, And The Future | Techfunnel. [online] Techfunnel. Available at: <https://www.techfunnel.com/fintech/digital-banking/> [Accessed 13 October 2020].

Lipton, A., Shrier, D., and Pentland, A., 2016. Digital Banking Manifesto: The End Of Banks?. 1st ed. [ebook] Cambridge, Massachusetts: Massachusetts Institute of Technology, p.7. Available at: <http://connection.mit.edu> [Accessed 15 October 2020].

Gu, M., 2020. Central Bank Digital Currencies (CBDC) Explained - New Revolution For Finance?. [online] Boxmining. Available at: <https://boxmining.com/cbdc/> [Accessed 17 October 2020].

Marous, J., 2020. The Rise Of The Digital-Only Banking Customer. [online] The Financial Brand. Available at: <https://thefinancialbrand.com/65628/digital-banking-consumer-trends/> [Accessed 18 October 2020].

AIDI PENG - Postgraduate student, Queen's Management school

Comments

Post a Comment