by Kate Wilson

In an increasingly online world, digital challenger banks are the ‘new kids on the block’ who are making huge waves in the banking and financial technology sectors. They are rapidly changing the way an ever-growing number of consumers manage their money and think about day-to-day banking. With a focus on user experience design and tapping into the potential of innovative technology, digital banks are disrupting the traditional industry and making a name for themselves as part of our ‘new normal’.

Reasons for growth and statistics

Many digital ‘neobanks’ are savvily targeting younger Millenial and Gen-Z users, who show less loyalty to traditional banks than their parents and are more likely to download a new banking app and try it out. In fact, the Millenial generation rank the world’s leading banks as some of their least loved brands, and 33% believe they will have no need for a traditional bank in the near future (Deloitte, 2017). Post-financial crisis, ‘disrupter’ banks are a breath of fresh air by focusing on what today’s consumers want from their banks. Exciting app features are a huge attraction. Revolut, which boasts 12 million users, allows for instant money conversion and transfers to other users and a bill-splitting function. Monzo lets users sort their funds into different ‘savings pots’, and Starling Bank provides insights for consumers to track their spending habits.

Environmental concerns have increased demand for paperless banking, but some take this a step further – Dutch digital bank Bunq offers to plant trees for every €100 spent by its Supergreen customers. Furthermore, in the age of the smartphone, many users simply prefer to ‘tap’ their phone to make a payment. This is made possible by eWallets such as Apple Pay, which accounts for roughly 5% of global card transactions (Detrixhe, 2020).

Recognising the appeal for a bank with top-tier efficient digital features and customer centricity is paying off for the banking revolutionaries. Revolut, which leads the way in user numbers amongst the top challenger banks, is valued at £1.3 billion and has expanded to thirty-seven countries. One of the first purely digital banks N26, based in Germany, have gained 6.5 million users across 25 markets since opening in 2015. In 2019, Monzo saw their valuation more than double in just eight months to over £2 billion, while Starling Bank increased their revenue to £80 million from £12,800 in 2016. (Woodford & Darrah, 2019). Digital banks are not only focusing on personal accounts, but small and medium-sized businesses too. ANNA Money markets themselves as the smart online banking business account for freelancers and SMEs and provides features such as invoicing and automated bookkeeping.

Predictions for growth

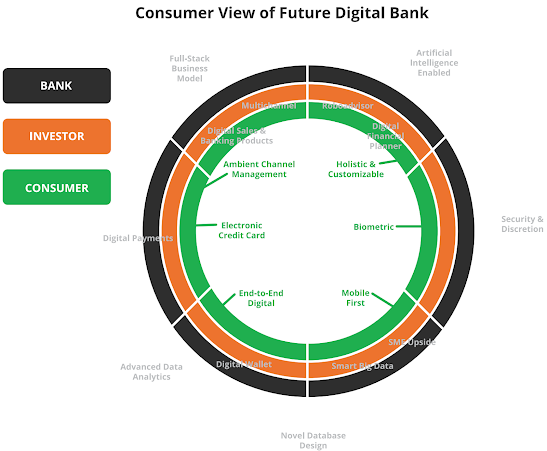

According to KPMG’s ‘The Future of Digital Banking Report’, we are predicted to see more changes in the banking industry over the next decade than have occurred in the past 100 years (KPMG, 2019). Research and figures clearly show a huge rise in usage and funding for digital disrupter banks, so is this the end of banking as we know it? Perhaps not just yet - many customers still prefer doing some of their banking at branches, and a large amount of digital bank customers use them in conjunction with another bank account (Dallerup et. al, 2018).

However, the banks that thrive in the future will need to embrace smart technology and use customer-centric strategies. Progressive regulatory schemes are also necessary to encourage banking innovation, such as more regulatory sandboxes to allow companies to live-test their product under supervision while ensuring legal compliance (Lumpkin and Schich, 2020). Fintechs will also need to have good relationships with bigger traditional banks who understand the importance of digitising - JP Morgan Chase, Goldman Sachs and Citi all have sizeable investments in the sector (Mention, 2019).

Undoubtedly, 2020 has been a pivotal year for digital banks. As we shift more towards remote-working and financial technology continues to become more integrated in our lives, we will continue to see growth in the global trend of digital banking.

Dallerup, K. et. al. (2018) A bank branch for the digital age, Available at: https://www.mckinsey.com/industries/financial-services/our-insights/a-bank-branch-for-the-digital-age (Accessed: 10th October 2020).

Darrah, K. and Woodford, I. (2019) Digital banks Monzo, Revolut, Starling and N26 compared, Available at: https://sifted.eu/articles/challenger-banks-monzo-starling-revolut-n26-compared/ (Accessed: 10th October 2020).

Deloitte (2017) Digital Banking Benchmark, https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-services/Banking/lu-digital-banking-benchmark.pdf: .

Detrixhe, J, (2020) Apple Pay is on pace to account for 10% of all global card transactions, Available at: https://qz.com/1799912/apple-pay-on-pace-to-account-for-10-percent-of-global-card-transactions/ (Accessed: 10th October 2020).

KPMG (2019) The future of digital banking, https://assets.kpmg/content/dam/kpmg/ua/pdf/2019/09/future-of-digital-banking-in-2030-cba.pd.pdf: .

Lumpkin, S., Schich, S. (2020) 'Banks, Digital Banking Initiatives and the Financial Safety Net:Theory and Analytical Framework', Journal of Economic Science Research, 3(1), pp. 24-46.

Mention, A-L. (2019) 'The future of Fintech', Research-Technology Management, 62(4), pp. 59-63.

Comments

Post a Comment